estate tax change proposals 2021

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. The proposed bill provides major changes to the estate and gift tax rules that could reverse parts of the Tax Cuts and Jobs Act of 2017 and significantly limit opportunities.

How The Tcja Tax Law Affects Your Personal Finances

From Fisher Investments 40 years managing money and helping thousands of families.

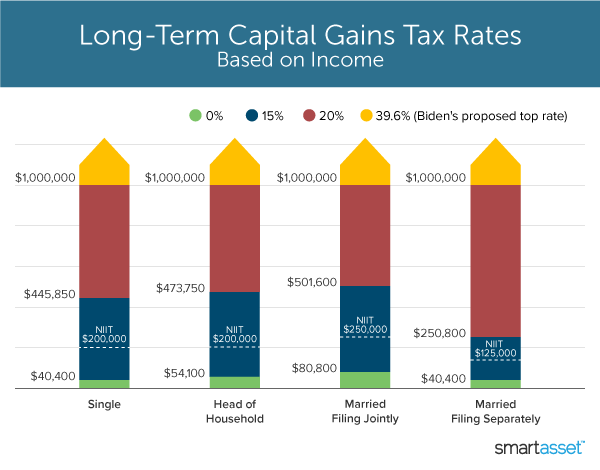

. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The top income tax rate of 37 and the top tax rate of 20 on investment income was not raised except for those subject to the surtaxes. Administration proposals included a provision to tax capital gains at death.

Increasing Tax Rates for Trusts and Estates. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for.

In April 2021 the Biden Administration announced the American Families Plan which proposed significant tax law changes to increase taxes on both corporations and high. The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35. The maximum estate tax rate would increase from 39 to 65.

The proposal seeks to accelerate that reduction. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Tax rates for C corporations were not.

Should this bill pass into law it means that. President Bidens new tax proposals to the Build Back Better Act are. Revise the estate and gift tax and treatment of.

Instead the exemption would expire at the end of 2021 and beginning in 2022 the Federal Estate Tax will be reduced to 5 million. That is only four years away and. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation.

And while the gift and estate tax exemption is scheduled to drop to approximately one-half the current amount on January 1 2026 there also are tax proposals in play that could. Proposals to decrease lifetime gifting allowance to as low as 1000000. Proposals to decrease lifetime gifting allowance to as.

Lifetime estate and gift tax exemptions reduced and decoupled. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500. The advice is from an experienced tax lawyer including ways to minimize the. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and Jobs Act of 2017.

Estate and gift tax exemption. The BBBA did not include a provision to tax capital gains at death or to impose a carryover basis in which the heir. Thankfully under the current proposal the estate tax remains at a flat rate of 40.

PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. Potential Estate Tax Law Changes To Watch in 2021. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

In this Boston real estate blog post find out what potential real estate tax changes to expect in 2021. If an individual dies in 2022 and his or her lifetime gift and estate assets add up to be. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of.

That is only four years away and. New Tax Proposals - Good News for Most Taxpayers - N ot Much is Scheduled to Change. The 2021 exemption is 117M and half of that would be 585M.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The proposed legislation would cause the increased exemption to expire at the end of 2021 instead of 2025.

What S In Biden S Capital Gains Tax Plan Smartasset

Proposed Tax Changes For High Income Individuals Ey Us

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

House Democrats Tax On Corporate Income Third Highest In Oecd

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Increases In The President S American Families Plan Itep

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

President Biden S Stepped Up Basis Tax Proposal Forbes Advisor

Estate Tax Law Changes What To Do Now

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

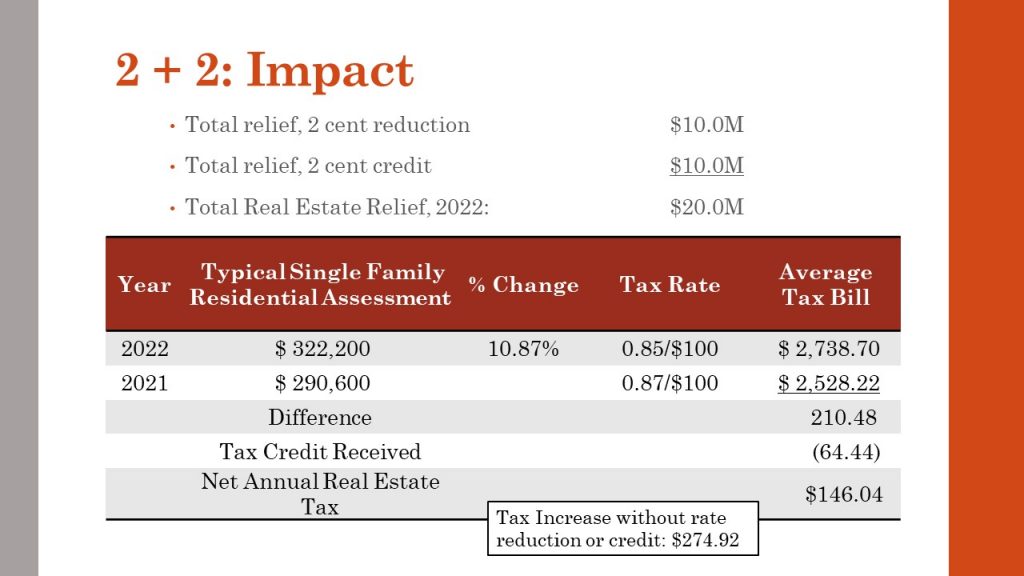

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

It May Be Time To Start Worrying About The Estate Tax The New York Times

Biden Tax Plan Here S How Taxes Could Be Raised On The Wealthy And Corporations Cnn Politics

Biden Tax Plan What People Making Under And Over 400 000 Can Expect

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube Estate Planning Checklist How To Plan Estate Tax

The New Death Tax In The Biden Tax Proposal Major Tax Change

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal